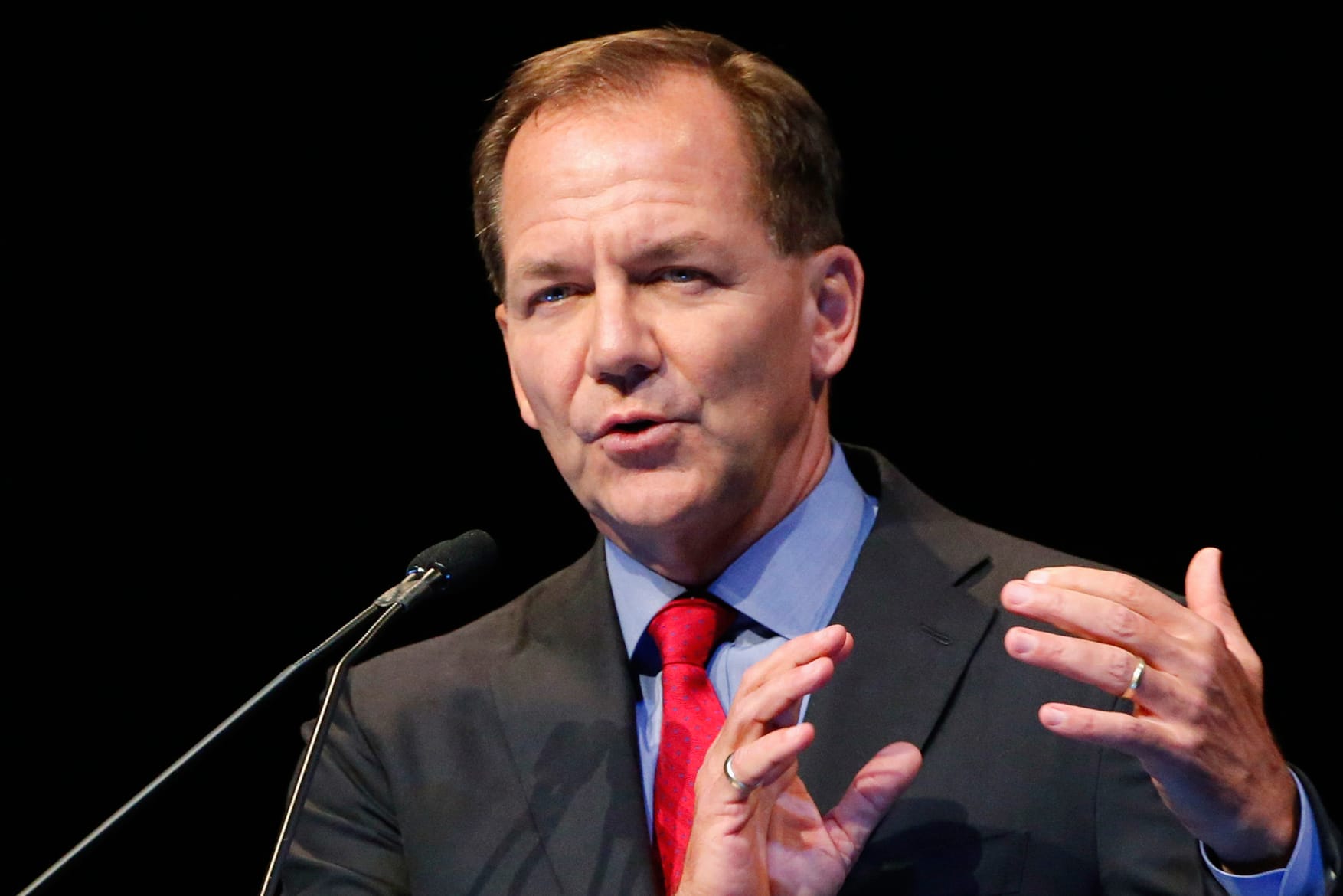

Paul Tudor Jones

Eduardo Munoz | Reuters

Billionaire investor Paul Tudor Jones told CNBC on Wednesday that the stock market will turn south if any Democrat wins the 2020 presidential election, regardless of the differences in their policy proposals.

"I think the stock market will definitely decline because that will assume that it's going to be accompanied by a raise in taxes," Jones said on "Squawk Box."

He added that the severity of the stock market's drop, if a Democrat wins, will vary depending on the candidate.

"Yes, it will decline somewhat," he continued. "I don't know necessarily if the economy's going to contract. We'll have to see what happens."

Otherwise, Jones said an "explosive" combination of monetary and fiscal stimulus is driving the stock market higher.

"We've got a 5% deficit coupled with the lowest real rates that you can image with the economy at full employment," he said. "That's the most unorthodox, and potentially explosive, combination that you can imagine."

Jones, who for years steered clear of any media appearances, has made a string of headlines in recent months stemming from his predictions for the 2020 election.

In a dialogue with Bridgewater Associates founder Ray Dalio last week, Jones said a poll at his investment firm showed employees believe the stock market would swoon if Sen. Elizabeth Warren comes out on top.

He said the consensus at his hedge fund, Tudor Investment Corp., is that the S&P 500 would fall 27% from its current level near record highs to 2,250 if the Massachusetts Democrat wins. Jones has a net worth of $5.1 billion, according to Forbes.

One of Warren's central campaign promises — and a policy lightning rod on Wall Street — is to introduce a wealth tax on America's largest fortunes. Her initial plan was to impose a 2% tax on households with a net worth above $50 million and a 3% tax on household over $1 billion.

She later upped that rate to 6% after detailing on her "Medicare for All" proposal.

Jones appeared to prefer South Bend, Indiana, Mayor Pete Buttigieg for president, applauding the candidate at a recent gala for iMentor, an organization that pairs adults with high school students for mentoring.

He also launched an exchange-traded fund based on social impact in 2018 that uses a model from Jones' foundation, Just Capital, that scores businesses on factors including worker treatment and environment. The fund is a selection of Russell 1000 companies, tracking the top 50% of those in each industry based on Just Capital's model.

The JUST U.S. Large Cap Equity ETF is up 23.4% in 2019, slightly outpacing the S&P 500's 23.3% gain, according to FactSet estimates.The ETF is not Jones' first foray into social change.

0 Comments